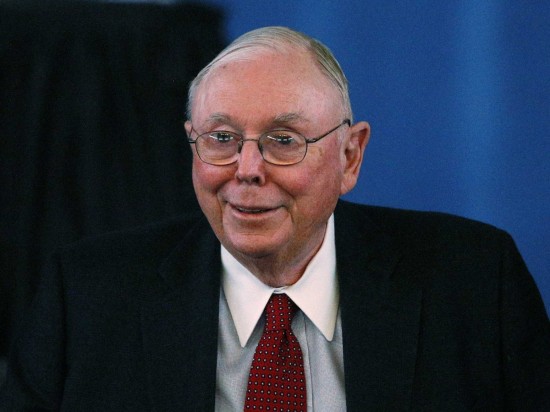

If you want to succeed in growing a great organization, you need several advantages to keep growing at over twenty percent per year for many, many years. How do we find a person whose strengths complement yours? Warren Buffett’s secret weapon and his close friend and business partner is Charlie Munger.

To succeed over the years, you need a partner in growing your business. In Warren’s case, he has several individuals helping him when he looks for business advice. The first is Charlie Munger and the second, who impacts Warren’s view of the future, is Bill Gates.

Today, I share several ideas on both these men and how they have impacted Berkshire Hathaway’s growth and long term success.

Charlie Munger’s impact would be they seldom invest in businesses that do not align with the customers’ wants versus needs. Warren relies on Charlie to help him see the bigger picture on his acquisitions and management style. Like any good partner, each can finish the other’s sentences when it comes down to business and investment strategies. Warren has said in interviews that he has never met a person with the same critical thinking skills as Charlie. He has helped avoid many deals that could have turned out as bad investments for the company. The joke between the men is if the corporate plane is going down and only one could be saved it should be Charlie. It tells you how much Warren values his impact on the organization’s success.

Having been on a call with Charlie many years ago, I would concur. I’ve watched him conduct interviews with many different great interviewers over the years and he continues to impress me with his grasp of the changing landscape leaders work in today. He provides almost immediate feedback on the many options we were trying to work through. The one thing that stood out at the time was his ability to understand a complex problem simply by asking several key questions to help identity the root cause of the issue. I had never seen an executive focus in on a wide range of options so quickly and then make a decision.

Charlie Munger has written many articles, speeches, and interviews on psychology, consumer bias, and investment markets. He takes a multi-disciplinary model to how he approaches business. He is very comfortable taking on the establishment when required. He is highly opinionated and is not afraid to ruffle a few feathers when it’s needed. Warren has cultivated a reputation of being cool headed in the most challenging situations. Charlie is known for getting to the point quickly, and letting the chips fall where they may. He is not afraid to say no. This may be his greatest strength on their leadership team.

The Poor Charlie’s Almanack, The Wit and Wisdom of Charles T. Munger was a staple in my office for many years when I was more active teaching in different MBA programs. I wore out my first edition sharing ideas from it with clients, students, and partners. I would say Charlie’s writing has impacted the way I look at organizational leadership more the Warren. I felt Warren’s financial skills were out of reach for most CEOs I know. Most leaders can significantly improve their critical thinking skills learning from Charlie. This is what makes them such a great team.

Here’s an interesting fact, I’ve been told is that the men and woman who work with Warren at very loyal to him. His ability to get the most from his team companies CEOs could provide a great example of how to empower executives in the future.

These leaders are from many different backgrounds, but all are connected through his and Charlie Munger’s leadership styles. Almost all the men and women who work for Warren could retire if they chose to, but they don’t because they feel a commitment not only to their teams, but to their leaders in Omaha.

Finally, the third element you must learn to build a business Warren Buffett would love is to buy and build. I’ve heard Warren and Bill Gates talk about this in several MBA level discussions they lead at their different business schools. It’s the ability to leverage and manage their capital.

Both men felt that today’s MBAs do not receive enough education in the critical area of capital management. I’ve offered to put together a class at Columbia with them, but so far no reply. Today, most business schools provide only a high level discussion on the topic. Warren has shared several ideas in a book and I will share it with you when we try to cover the topic in more detail.

Warren Buffett’s businesses are built on his ability to use strong cash flow to make acquisitions and finance his other business units. The financial service industry provides significant upside to grow other parts of the business. The CEOs across Berkshire Hathaway have to make decisions if they have the ability to generate a superior rate of return to other parts of the organization. Their decisions are also based on Warren’s ability to find significant investment opportunities to continue to keep him busy.

Over the past several years, he has begun investing outside the United States. Only time will tell if he is able to leverage Berkshire Hathaway to continue to find outstanding investment opportunities in these new emerging markets.

If you would like to know more about what Warren’s looking for in a business, you can read it in every year’s annual report. He dedicates one page in the report to focus on what he looking for. If you’re not certain, feel free to call me. I’m certain I can help connect you with the right people.

Leave a comment

You must be logged in to post a comment.