How important is to have an investing philosophy today as a serving leader? With all the turmoil we deal with, what’s the biggest challenge facing serving leaders in both their personal and professional lives? From my experience, it’s developing an investing philosophy in all aspects of your life.

An investing philosophy can help make your financial decisions so much easier. I’m not saying it’s easy, but I believe I can share several ideas today that will help you better understand what is needed to be successful financially in life. My investing philosophy has allowed me to take care of my parents and friends when I need to. It allowed my wife to retire at an early age.

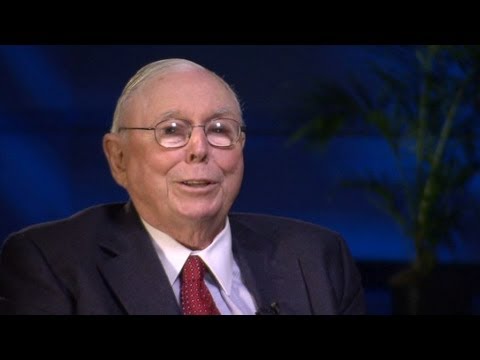

I wish I could say it was my investing philosophy that made such a huge difference, but I borrowed it from two men in 1986. I was lucky enough to learn it from Warren Buffett and Charlie Munger. I believe it can help you become a better investor. I know it has helped many of my better clients create better lives for their families, friends, and communities. So, the next two blogs will share what I’ve learned in hopes of helping you lead a more extraordinary life.

The first rule of developing a great investing philosophy is understanding that 10% of your success can impact 90% of your results. Warren Buffett learned from Benjamin Graham about value investing at Columbia. Charlie Munger helped refine how he adopted it to become the world’s best investor. I would add Philip Fisher helped as well, but when you study these great investors you see differences between their investing philosophies.We will talk about Philip Fisher in a future blog.

This is the first keeper that can make a huge difference in your results. You must be willing to learn even after you receive your formal education and early successes. Warren Buffett was willing to learn from others on how to improve what he was doing. Many of us would stop after learning a system that produced very good results. He was looking for extraordinary results. He credits Charlie Munger for changing his investing strategy to buy and hold great businesses. Today, many investors are caught in the transaction trap. The more, the better. Warren believes that for most people, they should strive to have no more than 20 major investment in their life.

Charlie shaped Warren’s thinking to focus his investing on only great businesses and hold them. That slight change from Benjamin Graham has allowed Berkshire Hathaway to become the 5th largest business in the world. Charlie Munger has worked with Warren for many years; they are a true executive partnership. Like most great couples they can finish each other’s sentences. They have a very synergistic relationship. So, who is your Charlie Munger?

The second keeper is from Charlie. He said “Most people who try [investing] don’t do well at it. But the trouble is that if even 90% are no good, everyone looks around and says, “I’m the 10%.” How realistic are you with your results in your area of expertise? Does your investing philosophy include becoming excellent at the critical parts of your career and business? A successful investing philosophy should mean you are constantly improving your key skills and capabilities.

The third keeper is from Warren Buffett. He said “Honesty is a very expensive gift, don’t expect it from very cheap people. “ How do you compensate the important people on your team? Do you get your advice from the best people around? I have a former client who was always cheap, not frugal. He would always beat down his advisors fees. He would not accept honest feedback on what he was doing. It didn’t take long to watch this man destroy billion dollar ideas by not getting good advice. He did not understand that many times you pay advisors to give you the news no one else would dare give you. Are you getting the best advice when it comes to your life?

A fourth keeper for your investing philosophy is that “An idea or fact is not worth more merely because it’s easily available to you.” This is one of my favorite quotes from Charlie. Charlie can be cantankerous with his opinions. He makes you think about things differently. He provides his unvarnished advice in a very down to earth way. Where I grew up we would call it blunt, but Midwesterners are show me people and Charlie Munger is more than happy to share.

I remember during the late 90s people thought short term investments and day trading was the way to go making investments. Every day when I worked as an executive I would have someone call to tell me about a stock that was too good to be true. Having served in a partnership role with many of the world’s best tech businesses I wasn’t always certain where these great tips came from. Some of these investment people where incredible storytellers. I have another word, but I don’t want to shock our younger readers.

But the information that is easily available, many times is just wrong. Warren often kids he lives in Omaha so he doesn’t get all the “hot tips” and bad information coming out of New York. I believe it’s for the burgers and shakes he gets at the local DQ.

The people offering these bad opportunities make them sound so simple a monkey would make the investment. Many monkeys did and all of them lost their bananas to the tune of millions of dollars. Are you making an investment decision because the information is easily available to you? A successful investment philosophy requires that you understand what a business does and how they make money over the long term.

Next week, I’ll share several practical tools to help you create your own investment philosophy as a serving leader. One that will fit your personality and needs. Investing is not only about the money you invest, but also where you invest your life. Your investment philosophy will also help you make better decisions on where you place your time and trust. See you next week.